Open enrollment season for health insurance is approaching. As a small business owner, you will want to determine whether your business is required to comply with the Affordable Care Act, and, if so, how best to do so. If you are required to comply with the Act and fail to do so you may face penalties. If you are not required to comply, but meet certain criteria, you may receive tax credits if you voluntarily do so.

Covered Businesses

- If you business has 50 or more full-time employees (including equivalencies) you must offer affordable health insurance that meets minimum standards. Full time is defined as working 130 hours a month (including vacations, holidays and sick days) or about 30 hours a week. To calculate, full-time equivalencies, add the hours of all part-time employees in a month and divide by 120. Then add this number to the number of full-time employees. If the total is 50 or more, the Act applies.

- If your business is smaller, while not required to comply with the Act, you may receive tax credits for doing so. Your business may be eligible for tax credits for complying if you employ fewer than 25 full-time employees, pay at least half of the employee’s insurance premium, and pay an average wage of less than $52,000, adjusted for inflation .

- If your business has fewer than 50 employees (100 employees in some states) you have the option to participate in Marketplaces through the Small Business Health Options Program. This program is designed to help increase the buying power of small businesses and help save you money.

Insurance Requirements

If you are required to comply with ACA, or are doing so to receive tax credits, you must document that the insurance you offer employees meets the minimum essential coverage requirements. In general, this means that plans must cover a variety of health care needs, not be limited to a specific disease or provide only discounts without providing insurance. You must also communicate benefits provisions, including coverage options, to employees and notify new employees about their health insurance options within 14 days of hiring.

Reporting Requirements

ACA also has reporting requirements. If your business issues 250 or more W-2s you must list the value of the health insurance benefits, including premiums, health savings accounts and wellness programs, that you provide to employees. Each year you also must file IRS forms 1094-C and 1095-C, which require monthly recordkeeping. You must also deliver 1095-C forms to employees.

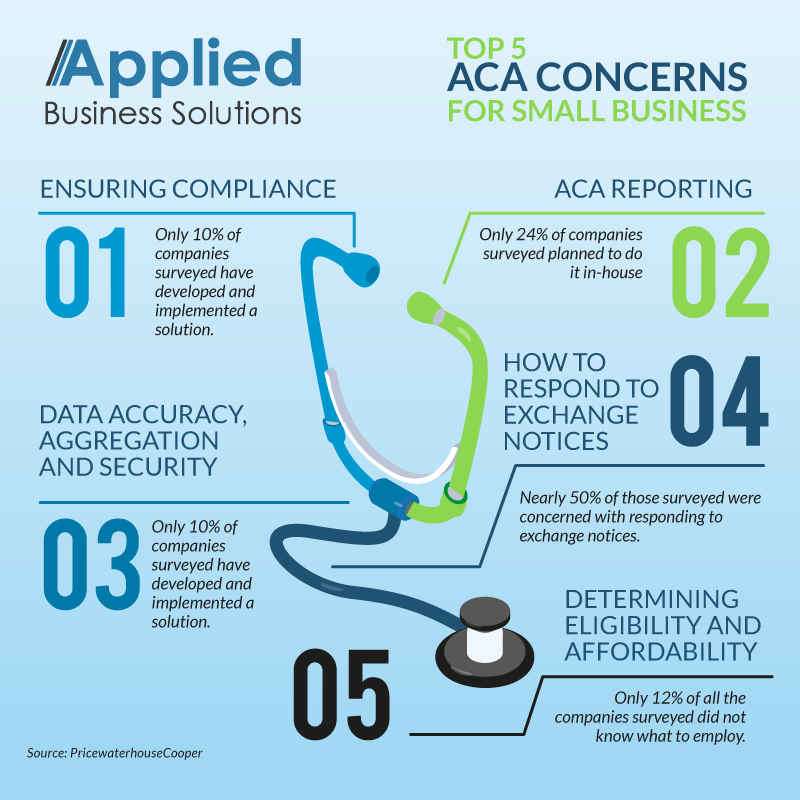

Achieving Compliance

You businesses may choose to handle all compliance issues yourself or contract with a professional employer organization, such as Applied. Professional employer organizations can handle all aspects of this process accurately and efficiently and help you avoid penalties. If you choose to handle compliance and reporting in-house, you will first establish which department or employee will be responsible for this. Then you would determine how best to capture and record the hours worked. Although reporting is annually, data must be captured monthly. This can be particularly tricky if your business employs seasonal or transient workers. Likewise, if your business employs workers over several states. you will need to find a way to respond to the health exchange notices from each of those states.

Source:

Affordable Care Act: Key Small Provisions

Understanding the Small Business Health Care Credit

Health Care Reform Checklist: Are You Ready?

Top 5 ACA Concerns for Small Businesses in 2016

Questions and Answers about Information Reporting by Employers on Form 1094 C and Form 1095 C

Looking for More Articles, Tips and News?

Get information about the things you actually care about: protecting your business, attracting and retaining employees and saving time so you can make money. Sign up for the Applied Business Solutions Toolbox and have them delivered right to your email inbox!